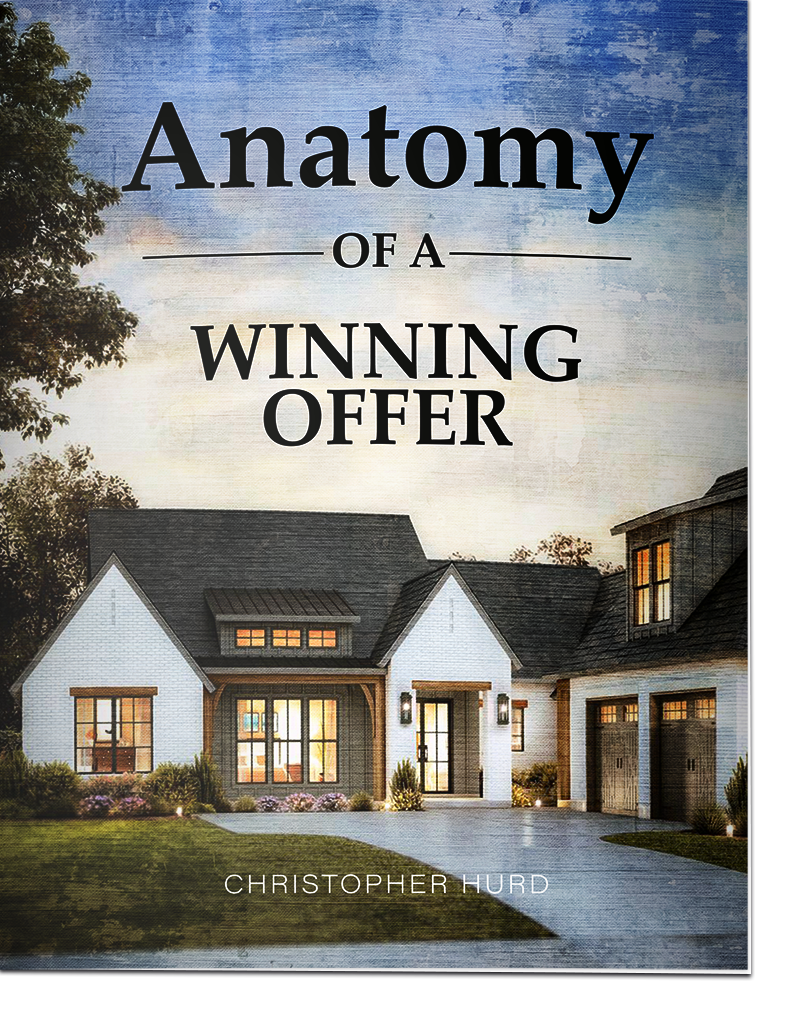

Increase your odds of an Accepted Offer

Making the highest priced offer is not always the winning offer.

Download Now

The Buyers Journey

The process of buying a home

step

1

Buyer Consultation

step

2

Pre-Approval

step

3

Search Properties

step

4

Submit Offer

step

5

Offer Accepted

step

6

Open Escrow

step

7

Closing Day

step

1

Buyer Consultation

step

2

Pre-Approval

step

3

Search Properties

step

4

Submit Offer

step

5

Offer Accepted

step

6

Open Escrow

step

6

Open Escrow

step

7

Closing Day

Agent Consultation

In this brief meeting, we’ll talk about what you’re looking for, such as house size, neighborhoods, and schools. We will also outline what to expect in the process so you have a clear path to your goal.

Pre-Approval Process

Why fall in love with a home only to find out it’s not in your budget? Before you get your heart set on a home, talk to a mortgage professional to find out what amount you can qualify for.

Lack of time at a job, insufficient credit, past bankruptcies, or other financial issues can cause major problems when trying to secure a mortgage.

That’s why nearly all sellers won’t even consider an offer from those who aren’t already pre-approved for a loan.

Tailored Listings For You

Say goodbye to endless searching. Get the most up-to-date listings tailored to your dream home criteria sent directly to your inbox!

Making An Offer

Once you have selected the perfect home, we work together to craft a fair offer based on the value of comparable homes on the market. Depending on the current market conditions and buyer demand, your offer may be below, at, or even above the asking price.

Beyond price will also discuss the terms of the offer, such as time frames for contingencies, credits, repairs, and occupancy.

We will be able to help you negotiate if you receive a counteroffer and reach an agreement. At this point, the house will go into escrow.

Typical items included when submitting an offer:

Purchase Contract | Pre-Approval Letter | Proof of Funds | Cover Sheet

Offer Accepted

This means you and the seller have agreed on all terms of the contract, which usually include:

* Purchase Price

* Inspection Contingencies and their time frames

* Closing Date & Pocession

* Escrow Deposit Amount

The Escrow Timeline

Your offer has been accepted. Now what? Here is an example of a 25-day escrow timeline:

Day 3 – Good faith deposit wired into escrow

Day 5 – Home Insurance Contingency

Day 7 – Investigation of Property Contingency

Day 12 – Sellers Reports and Disclosures reviewed

Day 14 – Loan & Appraisal Contingency

Day 20 – Buyer Final Walk-Through

Day 21 – Loan Docs to Escrow

Day 22 – Funding Due

Day 23 – Signing

Day 25 – Close of Escrow (You get the Keys!)

Here are your Keys

Congratulations! You are now the homeowner. Welcome home!

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

CAR Housing Affordability Fund (HAF)

The program helps first-time homebuyers bridge the affordability gap by providing them with up to $10,000 in closing cost assistance.